When millions of people type a car brand into Google, they’re telling us exactly what they’re considering for their next purchase. It’s the real-time pulse check on brand power.

We dug into 2025 Google search data from our Semrush account and cross-referenced it with Google Trends to see which brands are gaining ground and which ones are losing it heading into 2026.

Here’s what we’ve found. Toyota has 2.7 million U.S. searches every month (11.1 million worldwide) and interest climbed from 69 to 72. Tesla also gets 2.7 million U.S. searches (9.3 million globally) but interest cratered from 64 to 34. That’s a 47% nosedive.

Lexus has been quietly climbing, moving from 79 to 84 in user interest, while Hyundai jumped from 74 to 81, marking a 9.5% increase. Volkswagen got hit with the second-worst drop after Tesla. It fell from 97 to 62, a 36% slide.

If you bought a new car, Tempus Logix can ship it anywhere in the U.S. with fully insured, nationwide transport, transparent pricing, and dedicated support.

Put it all together and you can see which brands have real momentum going into 2026 and which ones are losing the interest. Below is the full list of the 20 most-searched car brands, ranked by search volume and public interest over the past year.

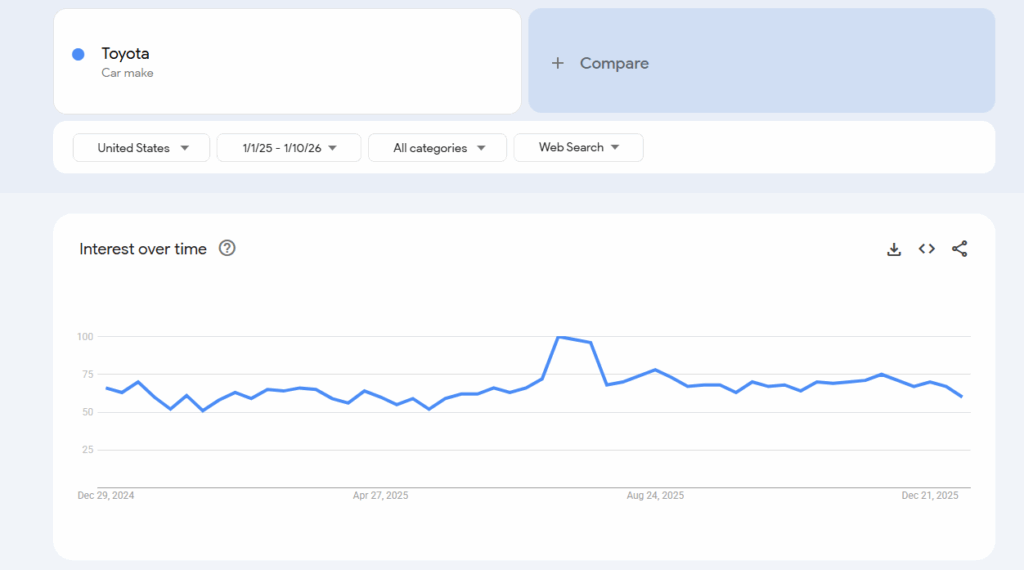

1. Toyota

- Monthly search volume: 2.7M U.S. | 11.1M global

- Google Trends Interest Index: 69 → 72 (stable)

- Toyota built up gradually through the year before hitting a massive July-August 2025 peak. Interest stayed elevated through year-end. The redesigned Camry and 4Runner launches drove a lot of this traffic along with their hybrid system updates. This shows why Toyota remains the market leader when it comes to getting people to consider buying.

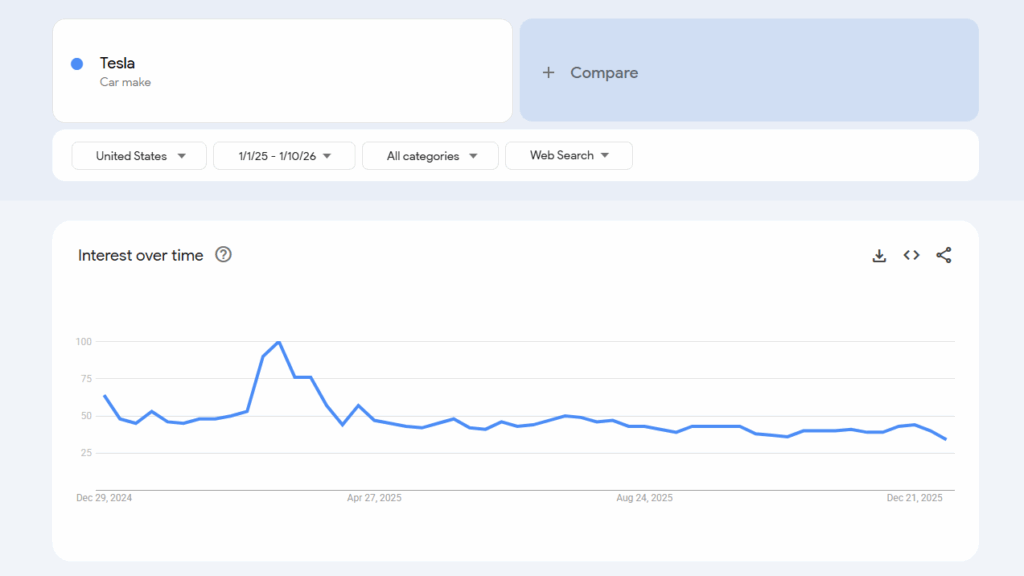

2. Tesla

- Monthly avg. search volume: 2.7M U.S. | 9.3M global

- Google Trends Interest Index: 64 → 34 (sharp decline)

- Tesla saw a dramatic spike in February 2025 before collapsing to 35-40 by year-end. The initial excitement over new model announcements got overwhelmed by pricing concerns and production issues. Elon Musk’s heavy political involvement also played a role. Brand controversies and intensifying EV competition eroded consumer interest throughout the year.

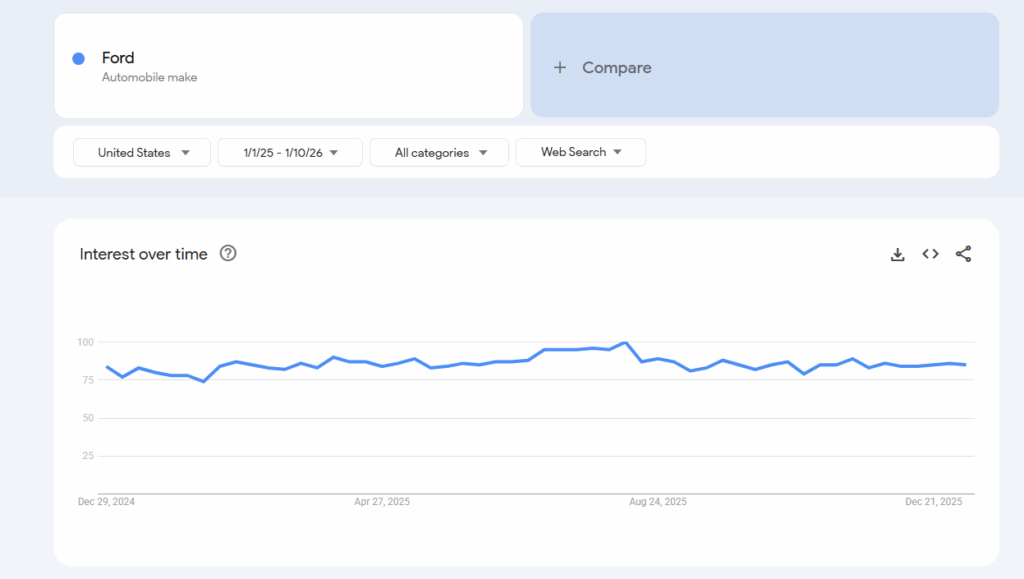

3. Ford

- Monthly avg. search volume: 1.2M U.S. | 4.4M global

- Google Trends Interest Index: 84 → 85 (stable)

- Ford showed rock-solid search interest all year with an August 2025 peak. The F-150 dominance keeps them on top along with ongoing Lightning and Mustang Mach-E updates. This brand’s position as America’s most-searched traditional automaker isn’t going anywhere.

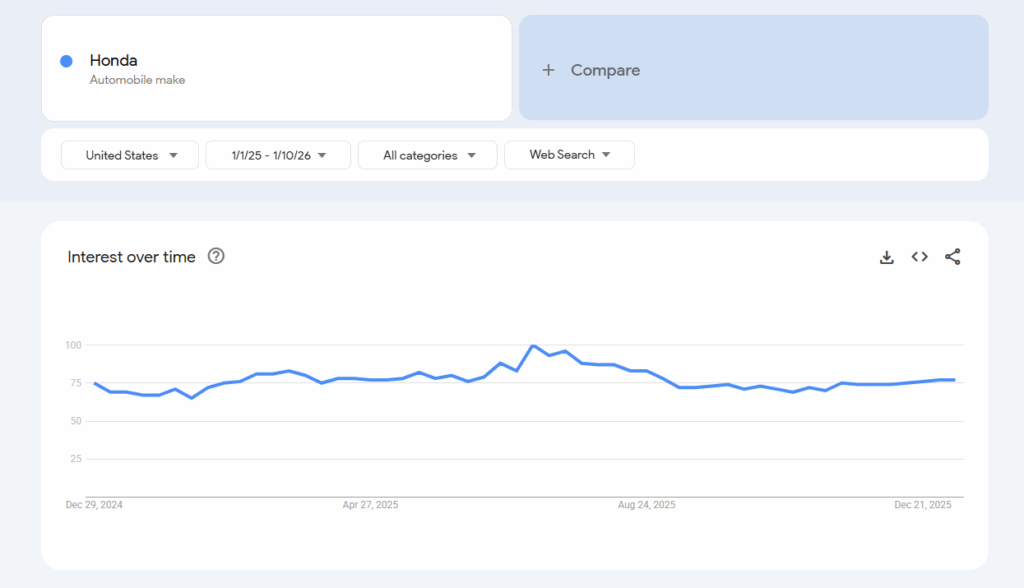

4. Honda

- Monthly avg. search volume: 1.2M U.S. | 7.3M global

- Google Trends Interest Index: 75 → 74 (flat)

- Honda climbed steadily to a big August 2025 spike. Interest stayed elevated afterward. The redesigned Accord and CR-V reveals drove this along with electric vehicle strategy announcements. Honda’s reliability reputation keeps attracting people amid all the market uncertainty.

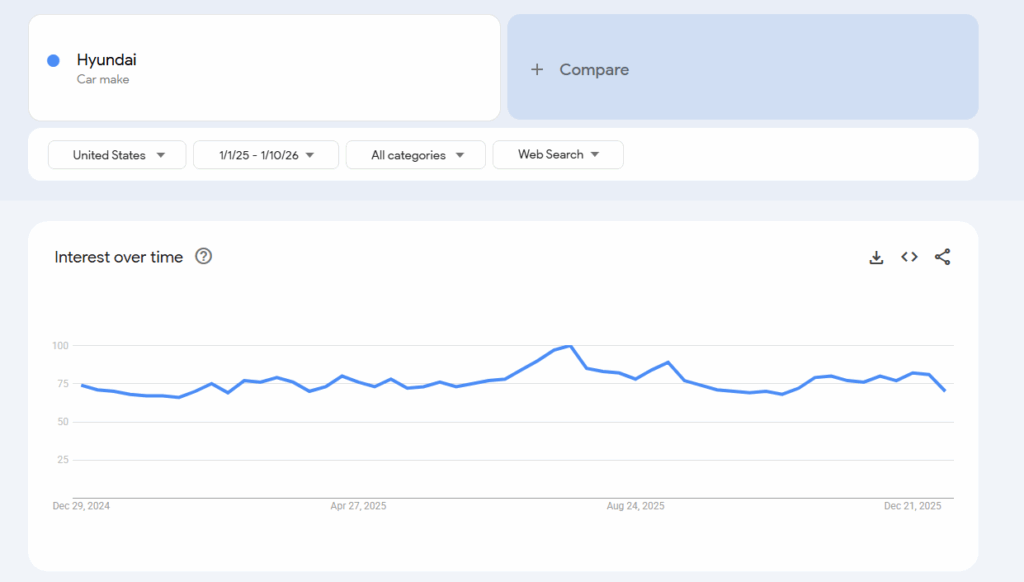

5. Hyundai

- Monthly avg. search volume: 1.2M U.S. | 6.4M global

- Google Trends Interest Index: 74 → 81 (stable)

- Hyundai held baseline interest before a dramatic August 2025 spike near 100. Then it returned to baseline. New Ioniq EV models and aggressive pricing strategies probably drove this. The value brand proved it can still generate periodic consumer excitement despite lower sustained search volume than competitors.

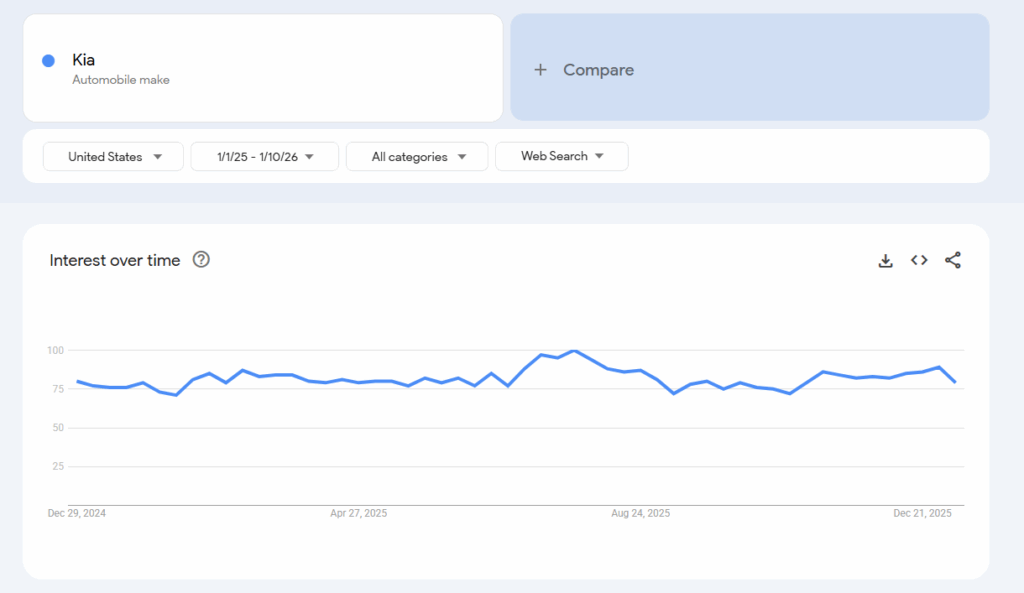

6. Kia

- Monthly avg. search volume: 1.0M U.S. | 5.1M global

- Google Trends Interest Index: 80 → 79 (stable)

- Kia stayed stable around 75-80 all year with a sharp August 2025 spike to 100. The EV9 three-row SUV expansion and aggressive value positioning drove this. The Korean brand successfully penetrated the mainstream market.

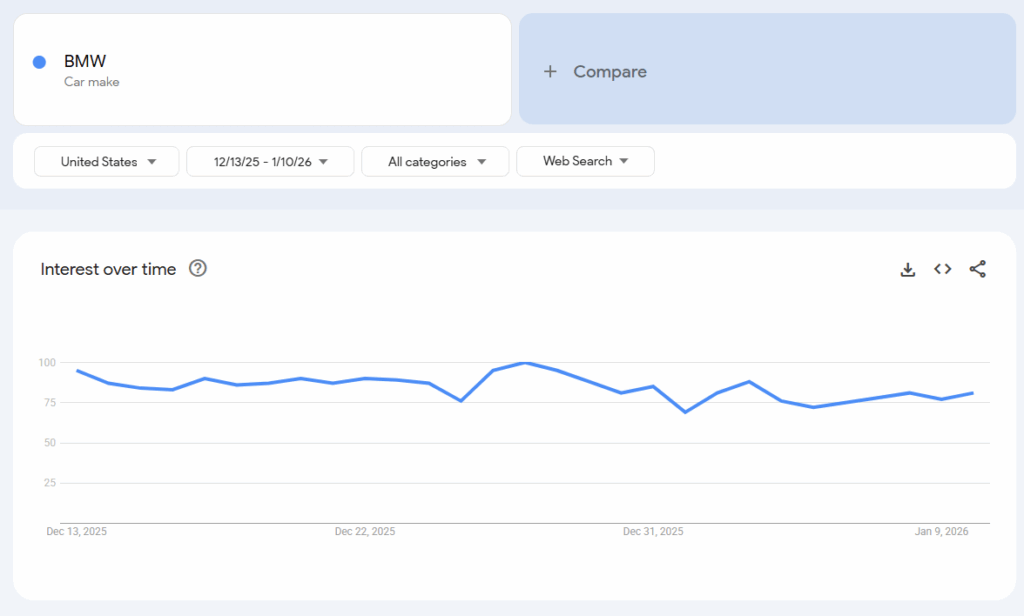

7. BMW

- Monthly avg. search volume: 1.0M U.S. | 8.7M global

- Google Trends Interest Index: 77 → 75 (stable)

- BMW maintained high baseline interest over the year with some holiday-period ups and downs. Summer 2025 brought a peak. Strong end-of-year shopping activity and year-end clearance interest is typical for luxury buyers. The brand holds its steady market position despite increased EV competition.

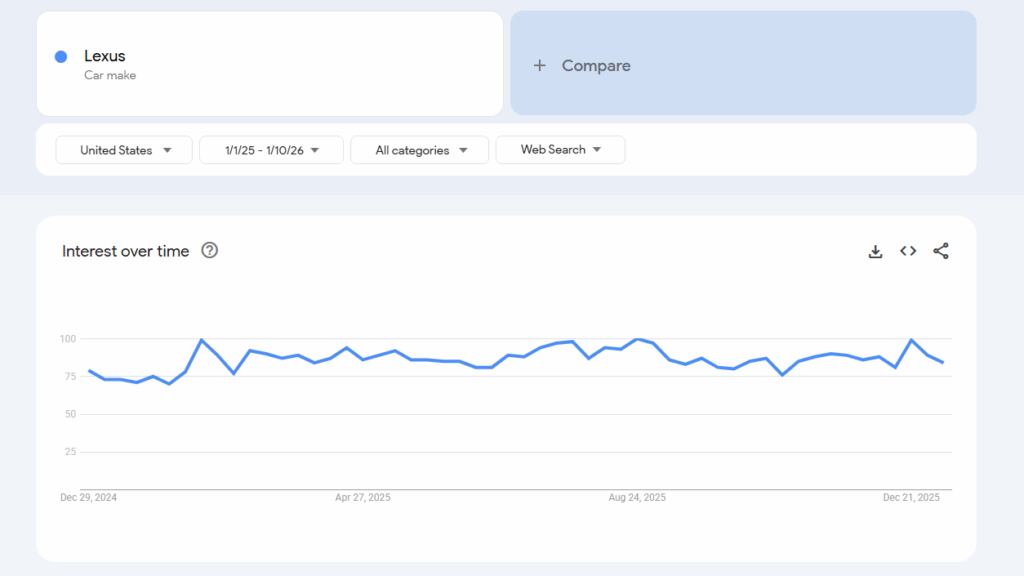

8. Lexus

- Monthly avg. search volume: 1.0M U.S. | 2.9M global

- Google Trends Interest Index: 79 → 84 (slight growth)

- Lexus showed high volatility with multiple spikes hitting 100 in early 2025, August, and late December. Redesigned RX and TX luxury SUV launches plus electrification announcements probably drove this. Toyota’s luxury division maintains strong consideration despite premium segment competition.

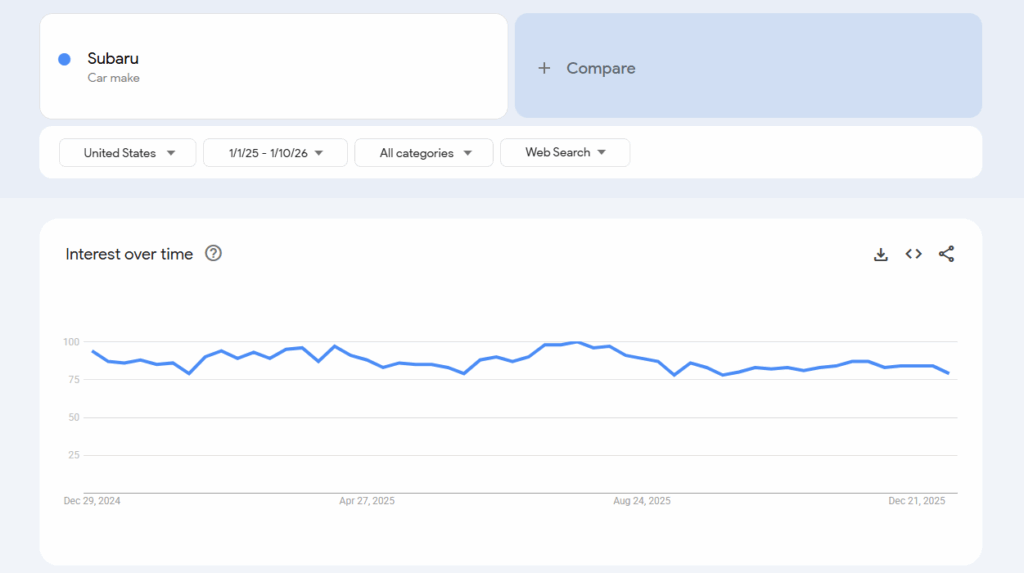

9. Subaru

- Monthly avg. search volume: 823K U.S. | 2.2M global

- Google Trends Interest Index: 94 → 78 (declining)

- Subaru started strong around 90-95 before peaking at 100 in August 2025. Then it declined to 80-85. Strong spring Outback and Forester shopping drove the early numbers. Model year transition and growing competitive pressure in the adventure vehicle segment brought the decline.

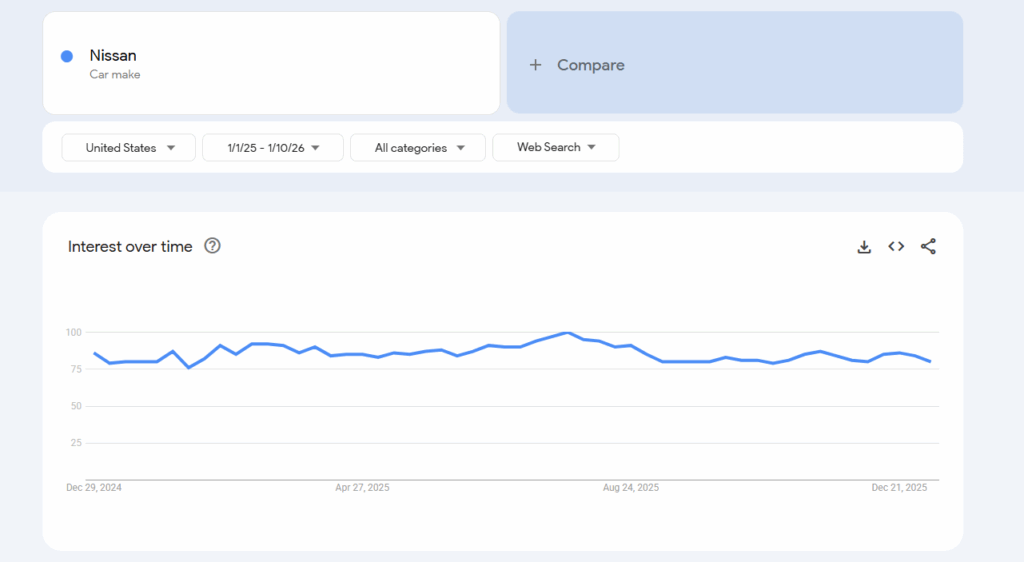

10. Nissan

- Monthly avg. search volume: 673K U.S. | 3.6M global

- Google Trends Interest Index: 96 → 80 (stable)

- Nissan held stable high interest all year with an August peak at 100. Redesigned Rogue or Ariya EV updates probably caused this. The lack of dramatic change suggests this struggling automaker is holding baseline awareness without breakthrough momentum.

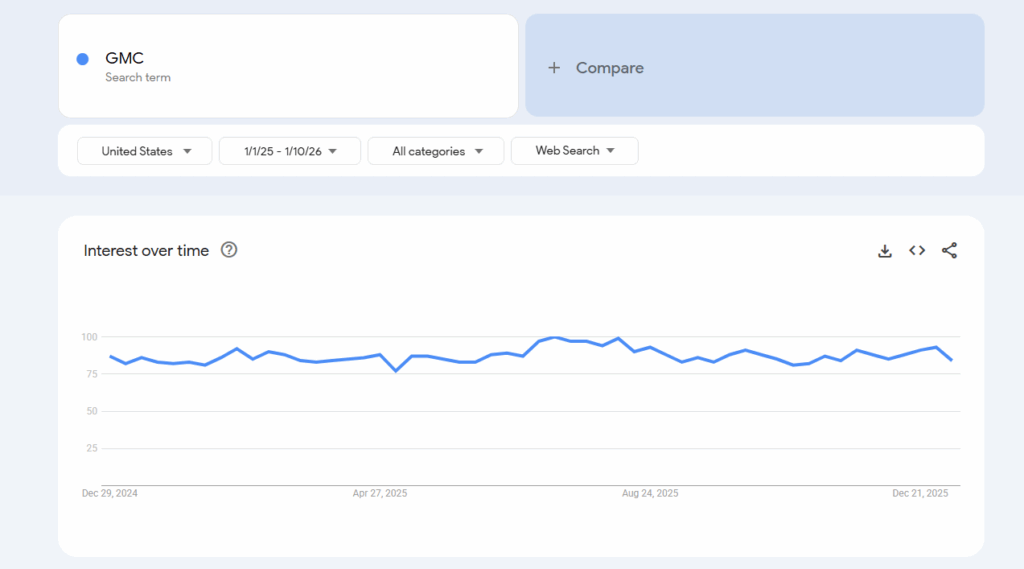

11. GMC

- Monthly avg. search volume: 673K U.S. | 1.4M global

- Google Trends Interest Index: 85 → 86 (mainly stable)

- GMC stayed consistent in the 85-95 range with an August 2025 spike to 100. Sierra updates or new Hummer EV variants probably caused this. Strong sustained demand for this premium truck and SUV brand within the GM lineup shows up clearly in the data.

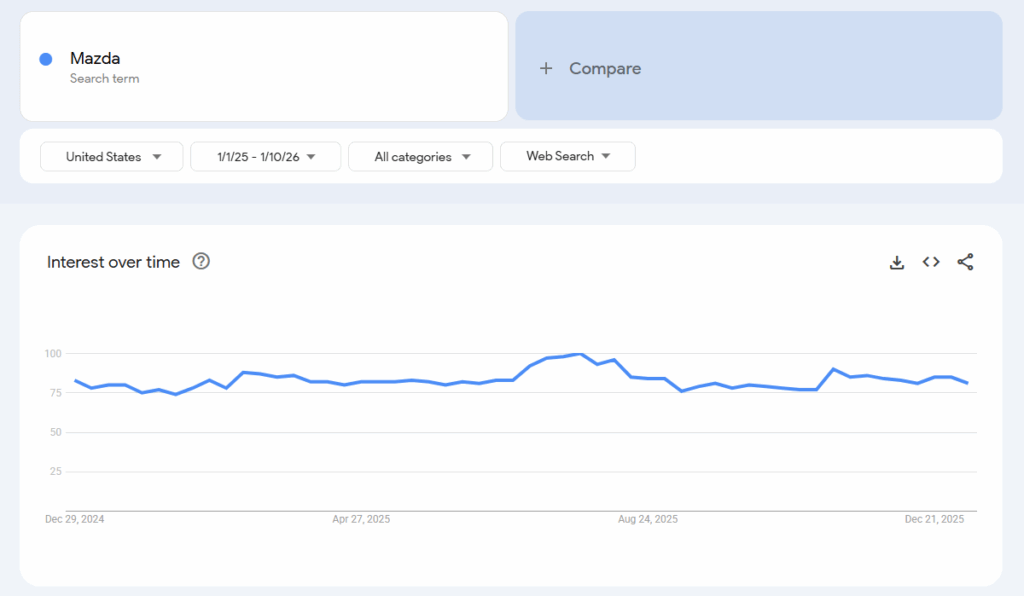

12. Mazda

- Monthly avg. search volume: 673K U.S. | 3.3M global

- Google Trends Interest Index: 83 → 81 (stable)

- Mazda showed remarkably consistent interest around 80-85 with an August 2025 peak at 100. CX-90 plug-in hybrid promotions or rotary engine revival news probably drove this. This smaller Japanese brand maintains steady niche appeal among driving enthusiasts.

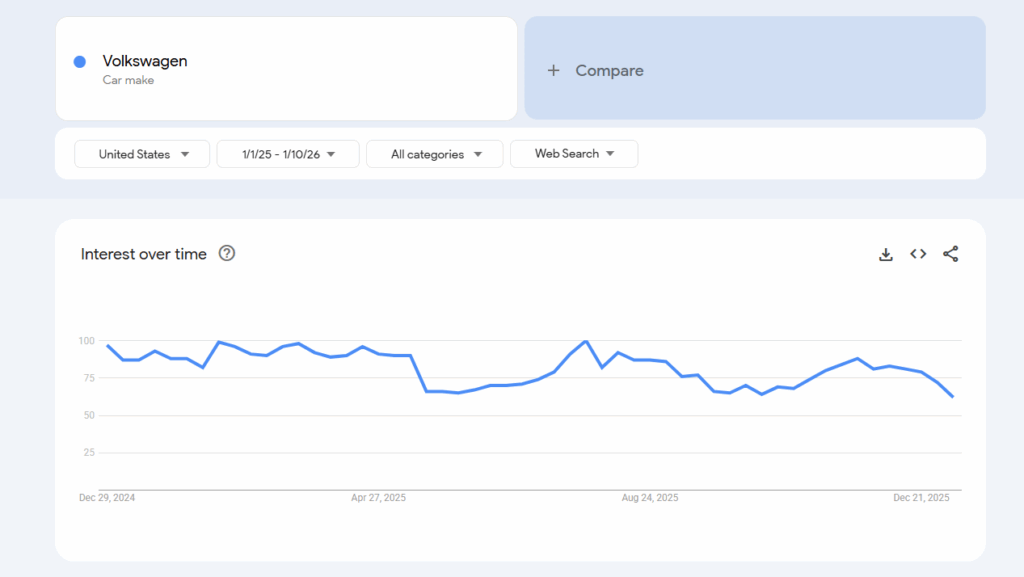

13. Volkswagen

- Monthly avg. search volume: 673K U.S. | 8.0M global

- Google Trends Interest Index: 97 → 62 (declining)

- Volkswagen showed high ups and downs. A sharp spring 2025 decline took it from 95 to 65. Then it recovered to 100 in summer before declining again to 65. Ongoing struggles with EV transition costs and competitive pressures created this pattern. Brand positioning uncertainty in the American market played a role too.

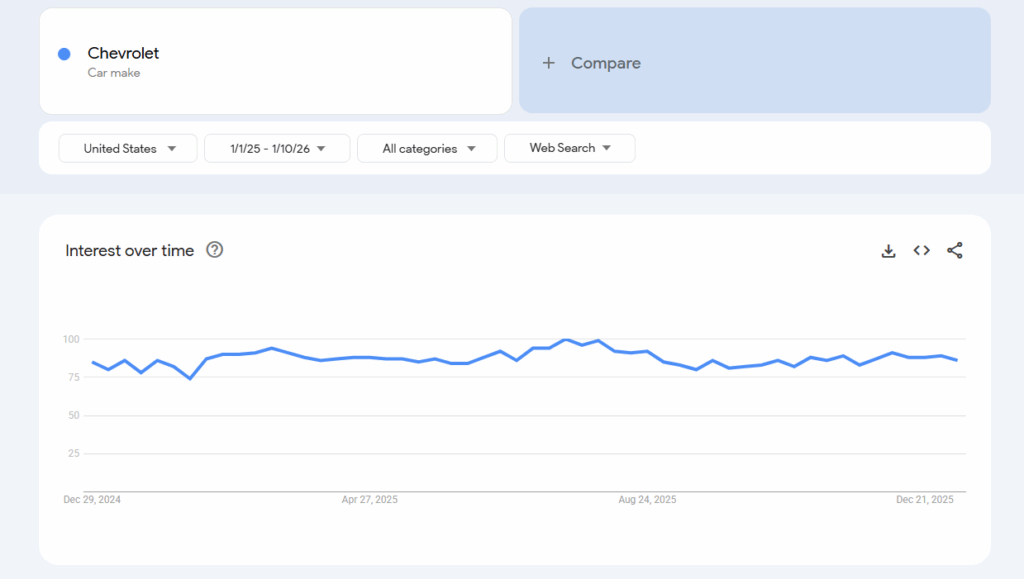

14. Chevrolet

- Monthly avg. search volume: 550K U.S. | 2.9M global

- Google Trends Interest Index: 83 → 85 (stable)

- Chevrolet kept remarkably consistent high interest across the entire year with an August 2025 spike to 100. The strong truck and SUV lineup plus new Silverado EV developments drove this. This mass-market brand maintains sustained relevance in American consumer searches.

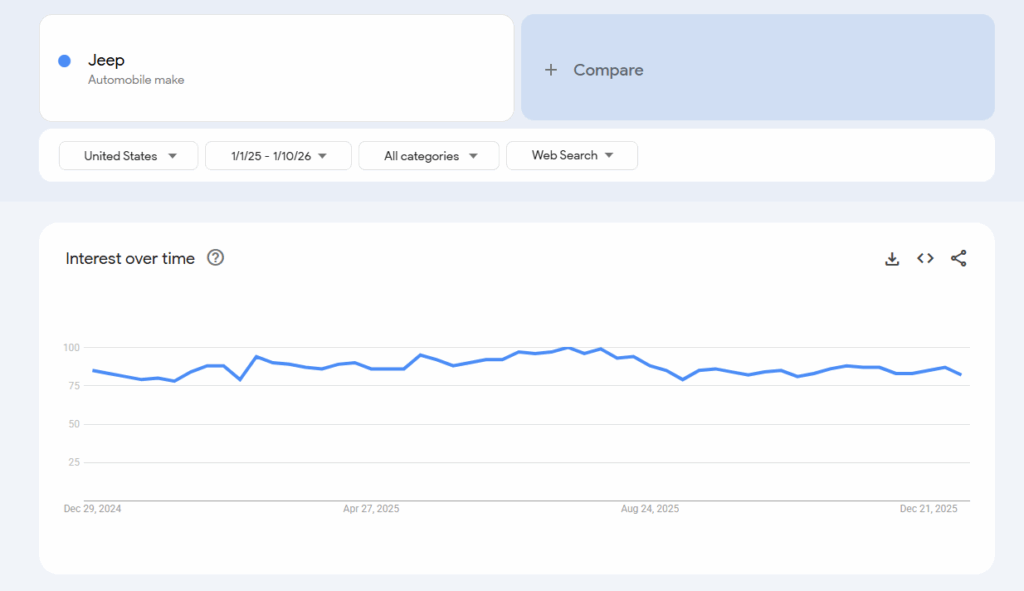

15. Jeep

- Monthly avg. search volume: 550K U.S. | 2.6M global

- Google Trends Interest Index: 85 → 82 (stable)

- Jeep showed steady upward momentum through 2025 with a big August peak. The 2026 model year reveals and new Wagoneer variant announcements drove this. Sustained consumer interest in this iconic off-road brand stays strong despite broader market headwinds.

16. Mercedes-Benz

- Monthly avg. search volume: 550K U.S. | 5.5M global

- Google Trends Interest Index: 76 → 75 (growing)

- Mercedes-Benz climbed gradually to a commanding August 2025 peak at 100 before stabilizing around 80. New EQ electric platform launches and S-Class updates drove this. The brand shows ongoing luxury market leadership and EV transition momentum.

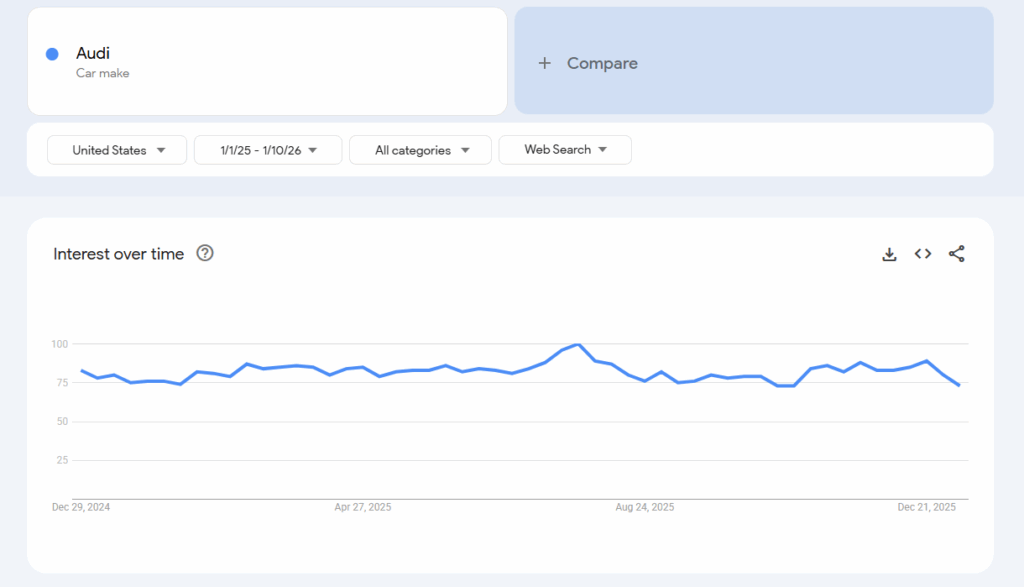

17. Audi

- Monthly avg. search volume: 550K U.S. | 4.2M global

- Google Trends Interest Index: 83 → 80 (stable)

- Audi held steady interest with a big spike near 100 in late summer 2025. New electric vehicle reveals (A6 e-tron) drove this. Sustained premium market positioning and consumer curiosity about upcoming model launches show up clearly.

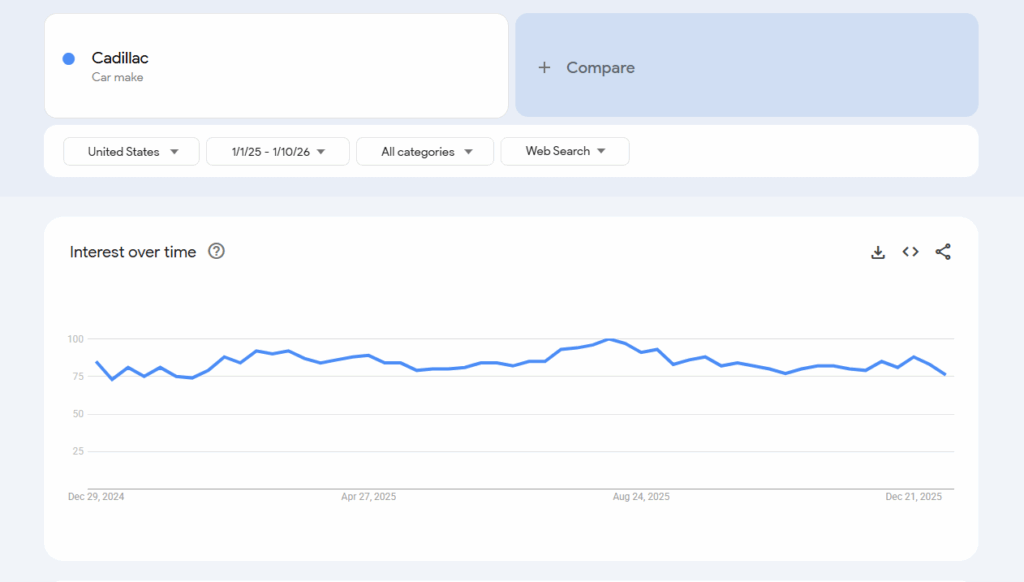

18. Cadillac

- Monthly avg. search volume: 550K U.S. | 1.5M global

- Google Trends Interest Index: 81 → 79 (stable)

- Cadillac stayed stable around 80-90 throughout 2025 with an August peak at 100. Electric Escalade IQ or Lyriq updates probably caused this. GM’s efforts to revitalize this luxury brand are keeping consistent consumer awareness.

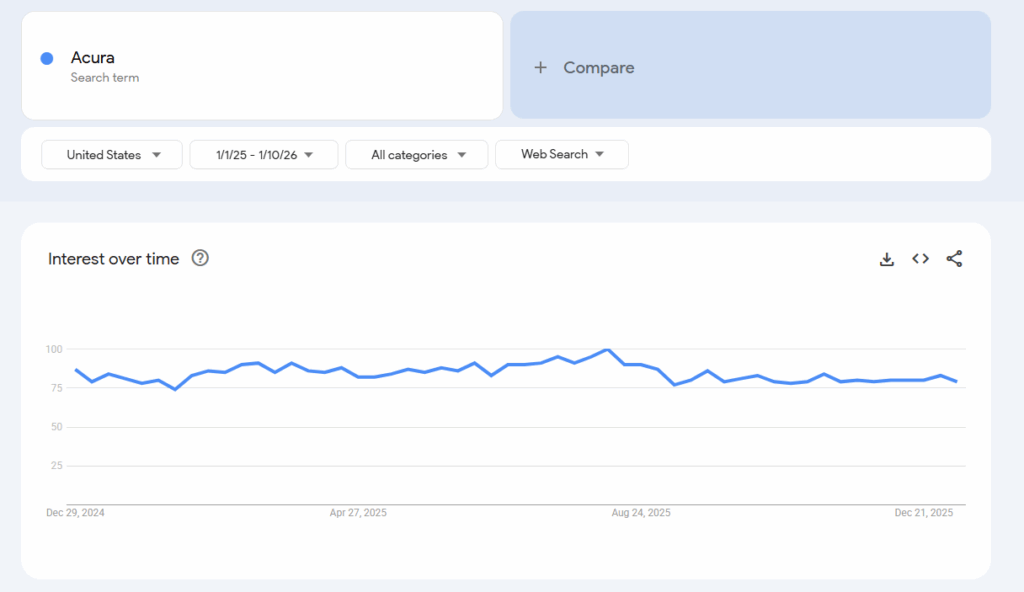

19. Acura

- Monthly avg. search volume: 450K U.S. | 709K global

- Google Trends Interest Index: 87 → 79 (flat)

- Acura kept relatively stable search interest all year with a notable spike to 100 around August 2025. The 2026 model year announcements or summer promotional campaigns probably drove this. Modest but consistent consumer consideration for this premium Japanese brand shows up in the data.

20. Dodge

- Monthly avg. search volume: 368K U.S. | 1.1M global

- Google Trends Interest Index: 90 → 84 (mostly flat)

- Dodge started with elevated interest peaking at 100 in early 2025 before stabilizing around 85-95. The historic transition from Hemi V8s to electric muscle cars drove this. Final ICE Charger and Challenger models also got attention.

Conclusion

The search volume and Google Trends data reveal clear patterns in consumer interest heading into 2026. Toyota leads with the highest U.S. search volume at 2.7 million (tied with Tesla). It shows stable growth all year, rising from 69 to 72 on Google Trends. Tesla generates equally massive U.S. search traffic at 2.7 million but faces the steepest decline in consumer consideration. It plummeted 47% from 64 to 34.

Brands showing positive momentum include Lexus (up 6.3% from 79 to 84), Hyundai (up 9.5% from 74 to 81), and Toyota (up 4.3% from 69 to 72). Volkswagen shows the second-steepest decline after Tesla. It dropped 36% from 97 to 62. Subaru fell 17% from 94 to 78 despite strong search volumes.

In the premium segment, BMW and Mazda stay stable while Lexus and Mercedes-Benz show encouraging growth. Most brands hit an August 2025 peak, probably tied to model year transitions and promotional campaigns.

We’ll keep this list up to date every month with new data, so be sure to bookmark this link as a resource you can use in the future.

Q/A

1. What is the most popular car brand in the U.S.?

Based on search volumes, we think Toyota is the most popular car brand in the U.S. right now. Toyota and Tesla both pull 2.7 million U.S. searches each month, but Toyota’s interest is growing while Tesla’s is dropping hard.

2. What is the most popular car brand in the world?

Toyota is the most popular car brand in the world based on search volume with million global searches every month, which puts it way ahead of the competition. Tesla comes in second with 9.3 million global searches, followed by BMW at 8.7 million and Volkswagen at 8.0 million.

3. How does Google Trends data help analyze car brand popularity?

Google Trends shows how interest changes over time rather than total volume. A rising trend such as Lexus at +6.3% (from 79 to 84) or Hyundai at +9.5% (from 74 to 81) signals growing consumer consideration. Declining trends such as Tesla at -47% (from 64 to 34) and Volkswagen at -36% (from 97 to 62) mean weakening demand or shifting preferences.

4. Which car brands show rising search interest?

Lexus, Hyundai, Toyota, and GMC all show positive Google Trends movement. Hyundai leads with the strongest growth at 9.5%, rising from 74 to 81. Lexus grew 6.3% from 79 to 84. Toyota climbed 4.3% from 69 to 72.

5. Why do some car brands have high search volume but declining trends?

High search volume with declining trends often means established brand awareness paired with cooling interest. Tesla shows this pattern most clearly. The brand attracts 2.7 million U.S. searches (9.3 million globally) but dropped 47% on Google Trends. It fell from 64 to 34 over the year. Volkswagen shows a similar pattern with strong global search volume but a 36% decline from 97 to 62.

6. Which car brands maintain the most stable search interest?

Ford, BMW, GMC, Mazda, and Kia show the most stable Google Trends performance. Ford held steady at 84-85. BMW stayed at 75-77. GMC held at 85-86. Mazda remained consistent at 81-83. This stability suggests reliable, ongoing consumer consideration without major market disruptions.

Data Sources

- Semrush is a market intelligence platform that estimates keyword search volumes using large-scale clickstream data.

- Google Trends is powered by Google’s own search data and shows how interest changes over time using a normalized index. This makes it especially reliable for spotting momentum, whether a brand is gaining, losing, or maintaining attention.

Image credit: Kayle Kaupanger on Unsplash.