The American auto market wrapped up 2025 with some interesting shifts. Toyota held onto its top spot. Electric vehicles continued their steady climb. But the real story sits in the details of who bought what and why these numbers matter for anyone planning to buy or ship a vehicle this year.

Understanding these sales trends helps you make better decisions. You might be shopping for a reliable daily driver. Or you need to transport a vehicle across state lines. Either way, knowing which cars dominated the market gives you useful context about availability and pricing.

Top 10 Best-Selling Cars in USA for 2025

The 2025 sales numbers are in. They show which auto brands dominated American driveways this past year. The competition stayed tight at the top. Toyota barely edged out Ford for first place.

| Rank | Brand | Units Sold | Source |

| 1 | Toyota | 2,147,811 | Toyota Motor North America |

| 2 | Ford | 2,097,256 | Ford Motor Company |

| 3 | Chevrolet | 1,829,235 | General Motors |

| 4 | Honda | 1,297,144 | American Honda |

| 5 | Hyundai | 901,686 | Hyundai Motor America |

| 6 | Nissan | 873,307 | Nissan Group |

| 7 | Kia | 852,155 | Kia America |

| 8 | GMC | 652,394 | General Motors |

| 9 | Subaru | 643,591 | Subaru of America |

| 10 | Mazda | 410,346 | Mazda USA |

Related Article: Top 20 Most Popular Car Brands in the USA by Search Volume

Toyota claimed the top spot with 2,147,811 vehicles sold. Ford came remarkably close with 2,097,256 units. The gap between first and second was only 50,555 vehicles across the entire year.

Chevrolet secured third place with 1,829,235 sales. Honda landed in fourth with 1,297,144 vehicles delivered to customers. Their light trucks and electrified models drove much of that growth.

Asian car makers dominated the rankings. Seven of the ten spots went to Japanese and Korean manufacturers. Hyundai sold 901,686 units. Nissan moved 873,307 vehicles. Kia celebrated record-breaking results with 852,155 sales.

GMC focused on trucks and SUVs to reach 652,394 sales. Subaru delivered 643,591 vehicles to buyers across the country. Mazda rounded out the top ten with 410,346 units sold.

Complete Rankings: Popular Vehicles by Sales Volume

The brand rankings tell only part of the story. Individual vehicle models reveal what Americans actually drove home from dealerships. The Ford F-Series claimed the top spot as the best-selling vehicle in America for 2024.

Ford’s second-place finish with 828,832 units came largely from F-Series truck sales. The F-150 has held the title of best-selling vehicle in America for decades. Ford’s strong 2025 performance suggests this continued through the year.

Toyota’s first-place brand ranking includes Camrys, Corollas, RAV4s, and multiple other models combined. Ford’s numbers heavily concentrate in their truck lineup.

The sport utility vehicle of the year category saw intense competition. Toyota RAV4 and Honda CR-V battled for compact SUV dominance. Both brands reported strong SUV sales as part of their 2025 totals. These practical crossovers remain family favorites.

Tesla’s electric vehicles continued gaining ground in 2025. While Tesla doesn’t appear in traditional brand rankings, their Model Y and Model 3 captured significant market share. The shift toward electric vehicles accelerated but didn’t dominate sales charts.

Truck sales remained America’s preference. Ford F-Series, Chevrolet Silverado, and GMC Sierra combined for massive volumes. Ram trucks from Stellantis also contributed to the pickup segment. These vehicles serve both work and personal use.

The sedan market continued shrinking relative to trucks and SUVs. Toyota Camry held its position as the best-selling sedan. Honda Civic maintained strong sales among compact cars. But sedan volumes pale compared to crossover and truck numbers.

Luxury vehicles posted respectable numbers in their segment. Lexus led premium brands with 370,260 sales in 2025. These luxury models represent a smaller but profitable market segment. Buyers in this category prioritize features and refinement over pure volume.

The most reliable car brands benefit from repeat customers. Toyota and Honda buyers often return for their next vehicle. This loyalty drives consistent sales year after year. Quality reputations take decades to build but pay off in sustained market share.

Year-Over-Year Comparison: 2024 vs 2025 Sales Leaders

Growth marked the 2025 sales year for most major brands. Toyota posted an 8% increase to reach 2.52 million vehicles sold. Ford achieved its best annual sales since 2019 with a 6% rise to 2.2 million units.

The hybrid strategy proved successful for several manufacturers. Toyota’s electrified vehicles accounted for 47% of total sales. Honda rode record sales of light trucks and electrified models to post an increase. This shift reflects changing buyer preferences.

Chevrolet contributed to GM’s 5.5% to 6% full-year growth. The redesigned Equinox saw a 32% sales climb. Strong Silverado demand kept Chevrolet competitive in the truck segment throughout the year.

Kia celebrated record-breaking results with 852,155 sales in 2025. Mazda reported strong full-year performance with 410,346 units sold. Both brands exceeded their previous best years.

The luxury segment showed mixed results across different brands. Lexus led premium manufacturers with 370,260 sales. Buick sold 198,155 vehicles while Cadillac moved 173,515 units.

Acura delivered 133,433 cars for a nearly 1% increase. The all-new ADX crossover topped 20,000 units in its first year. Lincoln posted 2% growth through November with Navigator sales up 43%.

Electric vehicle sales created the year’s most dramatic swings. Tesla’s Model Y saw an estimated 22% drop compared to 2024. GM’s EV sales plummeted 42% in the fourth quarter after federal tax credits expired.

Ford made a strategic pivot away from pure electric vehicles. The company decided to end F-150 Lightning production. The next generation will use extended-range electric vehicle architecture instead.

Supply chain issues affected several manufacturers during 2025. Toyota faced shortages of essential hybrid components. Acura dealt with microchip constraints that limited inventory of key models.

Some brands faced specific challenges beyond general market conditions. Lincoln’s China-built Nautilus encountered 125% import tariffs. This uncertain environment created headwinds for profitability and sales volume.

The Japanese automakers maintained their reputations for reliability throughout the year. Toyota invested $912 million in five US plants to expand hybrid production capacity. Honda’s diverse lineup kept customers returning to showrooms.

Fourth quarter performance varied significantly across the industry. Ford posted a 2.7% uptick to close the year strong. GM saw total sales decline approximately 7% in the same period. These quarterly swings demonstrate how quickly market conditions can shift.

Leading Automakers: Brand Performance and Market Share

The auto industry splits between domestic and foreign manufacturers. Each group brings different strengths to the market. Understanding these differences helps explain the sales results.

Domestic vs Foreign Brands: Who Won 2025’s Sales Race

In 2025, the US automotive market reached approximately 16.35 million total units sold. The market continues to be dominated by foreign-headquartered manufacturers, though domestic brands maintain a strong presence in the truck and SUV segments.

| Category | Total Units Sold (2025) | Market Share (%) | Key Manufacturers |

|---|---|---|---|

| Foreign Brands | ~9.39 Million | 57.43% | Toyota, Honda, Hyundai-Kia, Nissan, VW, BMW |

| Domestic Brands | ~6.96 Million | 42.57% | GM, Ford, Tesla, Stellantis (FCA US) |

1. Domestic Performance (42.57% Share)

- General Motors (GM): Remained the #1 automaker in the US with a 17.4% market share (approx. 2.85M units).

- Ford Motor Company: Secured the #3 spot overall with a 13.5% market share (approx. 2.2M units).

- Tesla: While facing a decline in growth, Tesla remains the dominant domestic EV player, contributing significantly to the domestic share.

- Stellantis (FCA US): Brands like Jeep and Ram are traditionally viewed as domestic in the US market, though the parent company is headquartered in the Netherlands. They accounted for approx. 7.7% share.

See The Sources: Yahoo Finance | NASDAQ

2. Foreign Performance (57.43% Share)

- Asian Manufacturers: Led by Toyota (the #2 automaker in the US with a 15.4% share), Asian brands (including Honda, Hyundai, Kia, and Nissan) collectively hold the largest portion of the US market.

- European Manufacturers: Brands like Volkswagen, BMW, and Mercedes-Benz maintain a strong hold on the luxury and premium segments, contributing to the overall foreign majority.

Key Insights

- The “Detroit Three” Evolution: The traditional “Big Three” (GM, Ford, Chrysler) now share the top tier with Toyota, which consistently challenges for the #1 or #2 spot.

- Production vs. Headquarters: It is important to note that many “foreign” brands (like Toyota and Honda) produce a significant majority of their US-sold vehicles in American plants, while “domestic” brands often import models from Mexico, Canada, or China (e.g., Buick Envision, Lincoln Nautilus).

- Market Trend: The 2025 market saw a slight shift toward foreign brands due to their stronger hybrid lineups, which met the surging consumer demand for fuel-efficient alternatives to pure electric vehicles.

Ford, GM, and Stellantis: Detroit’s Big Three Performance

Ford’s 2,097,256 sales kept them competitive at the top. Their truck lineup remains their bread and butter. The company released detailed fourth quarter results showing steady demand.

General Motors brands posted solid combined numbers. Chevrolet alone sold over 1.8 million vehicles. GMC added another 652,000 sales. Buick and Cadillac contributed in the luxury segment. Together they represent enormous market presence.

Detroit’s automakers continue adapting to changing preferences. They’ve invested heavily in electric truck development. The transition requires balancing traditional truck buyers with new EV customers.

Toyota and Honda: Japanese Automakers’ US Market Position

Toyota’s first-place finish wasn’t a surprise to industry observers. They’ve held this position for years. Their diverse lineup covers everything from economy cars to luxury SUVs. The Lexus luxury division adds premium sales.

Honda’s fourth-place ranking reflects strong brand loyalty. Their reputation for reliability keeps customers returning. The Acura luxury division supplements mainstream Honda sales. Together they represent over 1.4 million vehicles annually.

These manufacturers benefit from decades of building trust with American buyers. Their dealer networks span the entire country. Service parts remain readily available even for older models.

Interesting Fact: Did you know that Toyota owns Lexus?

Market Shifts and Industry Trends That Shaped 2025

Several factors influenced what Americans bought in 2025. Economic conditions affected purchasing power. Technology advances changed what features buyers expected. Supply chain improvements meant better availability.

The Electric Vehicle Transition: How Fast Are Americans Adopting EVs

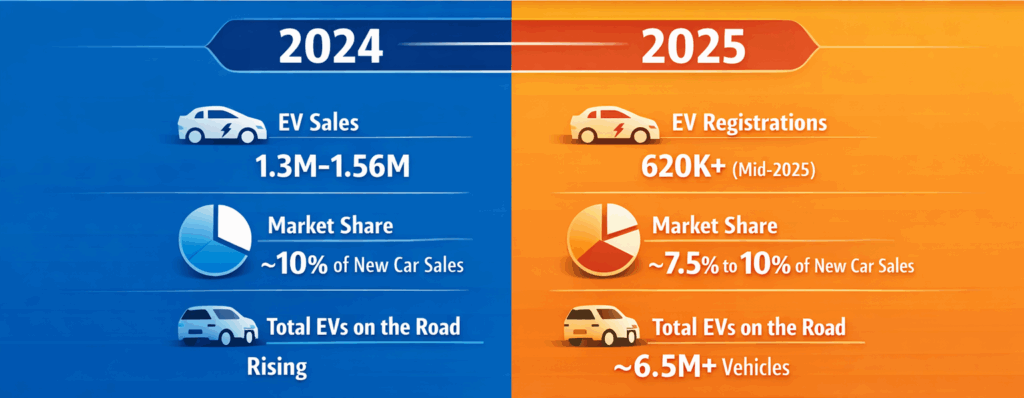

EVs gained more ground in 2025 but it wasn’t exactly a massive explosion. Sales in 2024 hit around 1.3 to 1.56 million units. That grabbed about 10% of new car sales. By mid-2025 there were over 620,000 new EV registrations and market share sat between 7.5% and 10%. A lot of buyers still want hybrids as their stepping stone to full electric. The charging setup kept expanding though you’ll still find gaps in rural spots.

Car companies poured billions into EV development. More models at different price points showed up so buyers could actually find something that fit their budget and needs. That helped push the total number of EVs on the road past 6.5 million in 2025 (Autos Innovate, 2025).

Most “unreliable vehicle” lists increasingly exclude modern EVs. Early electric cars had teething problems, but current models perform well. Battery warranties of 8–10 years provide additional confidence for buyers, complementing the steady growth in adoption.

Supply Chain Recovery: How Production Affected Availability

The semiconductor shortage that plagued earlier years mostly resolved. Manufacturers could build vehicles faster and more consistently. Dealer lots filled back up with inventory.

This improved availability changed the buying experience. Customers could actually see vehicles before purchasing. The days of ordering blind and waiting months started fading. Test drives became normal again.

Some manufacturers did stop selling certain truck configurations. The focus shifted to higher-margin models. This strategy helped profitability even if total units didn’t grow dramatically.

Final Conclusion

Sales data provides practical insights beyond just rankings. Popular models have better parts availability. High-volume vehicles cost less to insure and maintain. Resale values hold stronger for best sellers.

Auto transport companies see these patterns too. Routes between popular states get more carrier availability. Shipping a common vehicle type often costs less than rare models. The economics of scale work in your favor.

See Also: How Fast Car Shipping Actually Works

Understanding the best-selling vehicle in America helps you make informed decisions. You might be buying new or shopping used. Maybe you’re planning vehicle transport. Either way, these numbers matter. They reflect millions of individual choices and real-world performance.

The 2025 sales results show that Americans still love their trucks and SUVs. Asian car makers continue earning customer trust through reliability. Electric vehicles gain ground steadily without dominating overnight. The market remains competitive and diverse.

If you’re planning to ship a vehicle this year, these sales trends affect pricing and availability. Popular routes see more carriers and better rates. The most sold cars in USA 2025 will likely ship more easily than rare models. Understanding the market puts you in a better position when booking transport.